So we are in the second year of an incredible roller coaster, when the bills continue to rise and the economy is staring into the abyss from the top of the ride.

Food retail is one of the industries where inflation is most obvious.

A quick example: an average price of a dozen of grade A large eggs in the US (Source: U.S. Bureau of Labor Statistics) in January 2022 was $1.929 and in January 2023 already $4.823. An increase of 250%!

Yet, as one might intuitively guess, consumption of eggs did not decline. It is stable.

In an imaginary world of economics, this means that an egg’s price is “inelastic”.

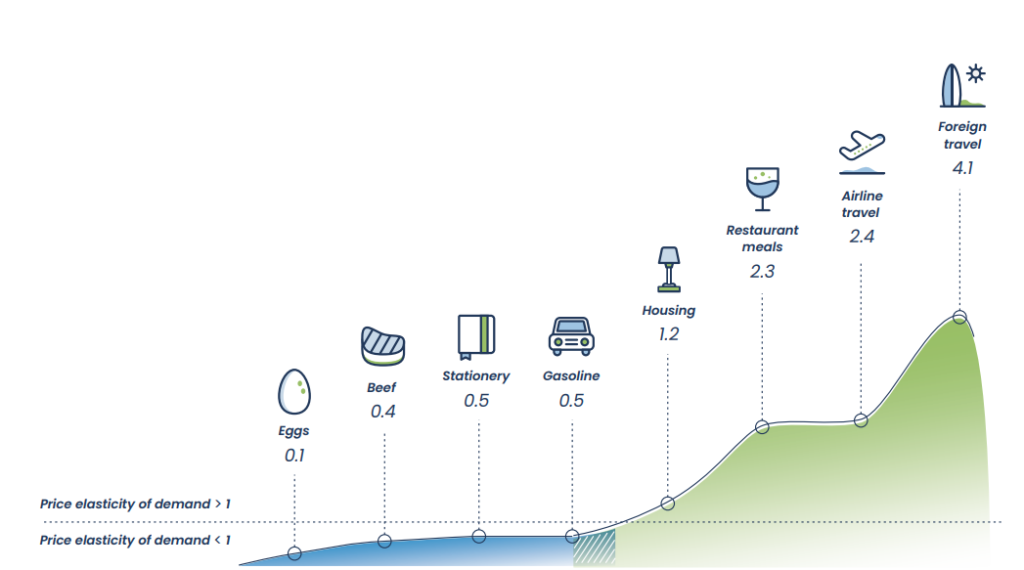

In the graph above you can see a very small factor of elasticity of eggs, equal to 0,1 (elasticity index below 1 means that an additional 1% price increase results in a less than 1% quantity decline; elasticity index above 1 means that an additional 1% price increase results in a higher than 1% quantity decline).

So, groceries in general are inelastic, as they represent a commodity that we cannot live without and would need to purchase anyway.

Often times, these products come from local farmers, who rarely can have an upper hand in negotiations with professional buyers. Thus, in most countries, governments grant farmers extra protection. It exists in several forms, from an unconditional price acceptance by retailer, to the strict regulation of both buying and selling prices and in some extreme cases, to establishing caps on the profit margins of the “essentials” food basket.

Last year several EU countries removed Value Added Tax from grocery products to limit the inflation burden on their citizens.

On the other hand, most of FMCG products, like home and personal care are elastic.

Not only HPC producers must avoid inflation if they want to grow their sales, but what is more, they need to constantly sell on promotion (elasticity index >1)!

In some categories, sales with discount represent from 50% to 80% of total sales.

Business models of FMCG suppliers are built on higher than average margins, offset by the volume of discounted products.

Raw materials and energy inflation represent a small increase in the cost of the final product and can be mitigated by

(a) direct and often disproportional price increases;

(b) lowered discounted/promotional activities;

(c) shrinkflation

and notorious and most famous (d) cost cuts.

Needless to say that all top FMCG manufacturers are the experts in this game and have managed to grow both their top and bottom lines last year, declaring record breaking results while paying the biggest ever dividends to their shareholders.

Highly recommend Noam Chomsky’s “Profit Over People” if you want to understand better this broken system.