French retail continued its strong transformation in 2024.

Non-food, petrol, and apparel remain among the biggest “casualties” of post-COVID consumption decline.

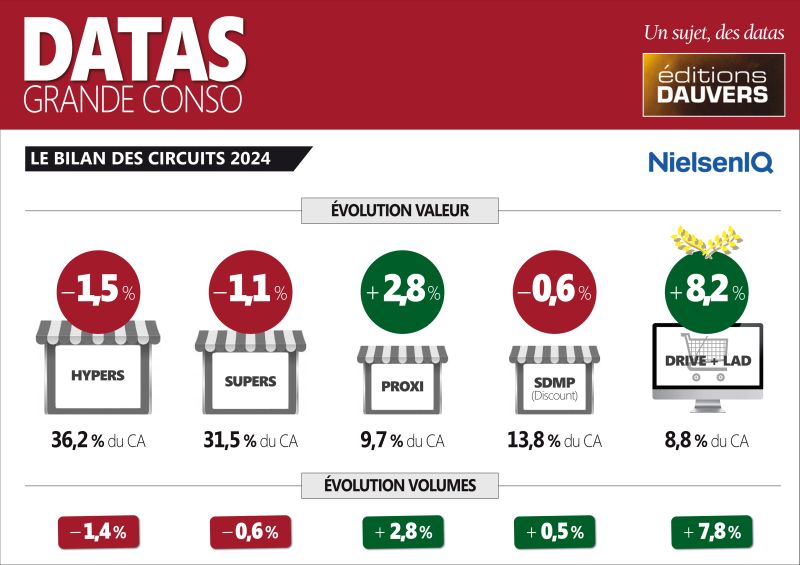

Hypermarkets are still the preferred shopping destination, as shoppers continue to hunt for promotions and save on volumes.

The rebound of click-and-collect (which peaked at 12% during COVID) is primarily driven by E.Leclerc’s widely publicized low-price strategy and shoppers’ desire to control “out-of-pocket” spending.

The same logic applies to proximity stores, where lower basket sizes provide a strong incentive to avoid driving to the hypermarket, saving on petrol and impulse purchases.

2025 will be a year of:

– Continued hypermarket share decline, with ongoing decreases in non-food sales driving the need for space optimization. The convergence of hypermarkets and supermarkets now seems inevitable.

– Click-and-collect will continue its growth, as retailers begin implementing AI agents to facilitate recurring purchases, introduce virtual personal shopper, or a chef.

– Uncertainty around failing EDLP concept. Will Lidl’s new management be able to stabilize company’s market share and reach break-even? And will Aldi remain in France at all?