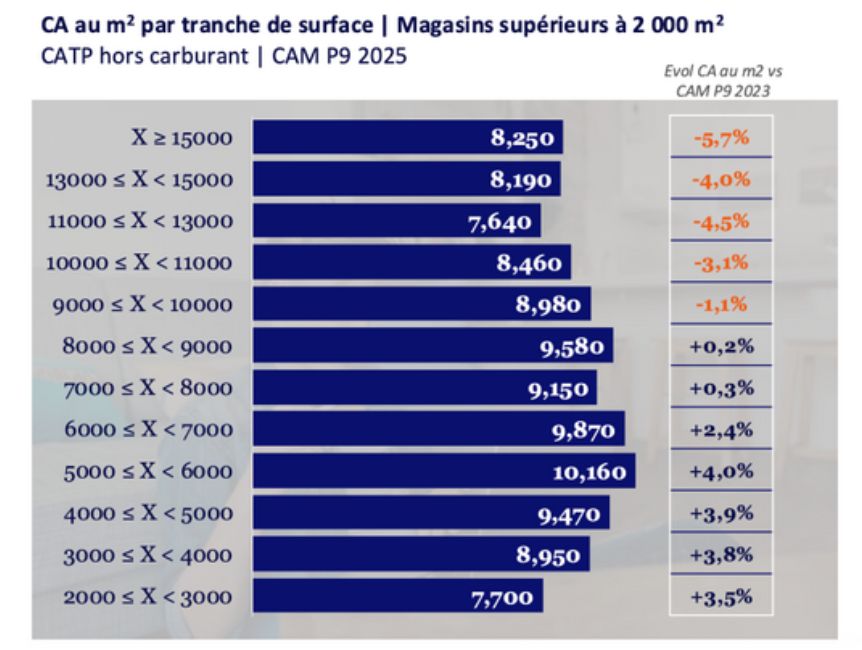

NielsenIQ published the sales dynamics by store size clusters in France. Shoppers are visiting large stores less and less.

The French hypermarket is not dead, as some like to claim. It is adapting to new households, which continue to grow in number (+6% since 2015) but are smaller in size (2.2 people on average today vs. 3.1 in 1960 when the hypermarket model arrived to France from the US). These households drive and consume less, despite having higher incomes.

Some categories, such as cleaning products, benefit from the growth of smaller households, while others, like beauty, suffer significantly as consumption shifts online or to the specialists.

The French version of click & collect, called “Drive” – often attached to the back of the hypermarkets continues to grow, slowly transforming them into the “dark stores”. Logic suggests that shopping centers built around such Drives could benefit by extending the hypermarket’s online offer, but a proven and profitable model has yet to emerge.

French retail transformation is probably unique and quite painful. No other European consumers have been favoring hypermarkets as much as the French. Proof? Carrefour and Auchan exit from Italy, with Carrefour potentially leaving Poland and Romania this year. Tesco leaving Poland, Hungary, Czechia and Slovakia. Real leaving CEE and disappearing in Germany. And finally, even Walmart leaving Germany and offloading the UK.

On the other hand, strong international growth of Couche-Tard (average store 100m2), Jeronimo Martins (average store 700m2) and Mercadona (average store 1300m2) demonstrates the potential of specialised proximity actors.